Wijeratne Bandara

Wijeratne Bandara

Superintendent

Post Clearance Audit Branch

Sri Lanka Customs

Public Finance Program (’02)

Please tell us about your career path so far. What is your area of specialization and how did you come to work in this area?

I started my career as an Audit Examiner in the Department of Auditor General’s in 1987. After one and a half years’ of service in the Department of Auditor General’s I was selected through a very competitive exam to the Department of Sri Lanka Customs as an Assistant Superintendent of Customs in 1989. However, my ambition was to join the Department of Inland Revenue after completion of my degree. Therefore, while I was working at Customs I sat for the open competitive exam and was able to get through this exam and selected to the Department of Inland Revenue as an Assessor. Then I had to make a choice whether to continue my service in the Customs Department or to resign from the Customs service and join the Department of Inland Revenue. In the end, I decided to continue in the Customs service. I feel that this is the most suitable employment for me because so far it has provided me with many opportunities. The best opportunity I got out of this job is the Japan-WCO scholarship awarded to me to study at GRIPS.

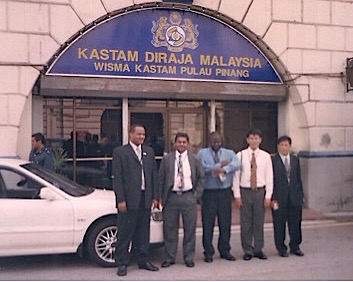

At a training programme on commercial frauds organized by the Malaysian Customs, in 2005

After 24 years of successful service in various branches and divisions in Sri Lanka Customs I was promoted to Superintendent of Customs in 2013. Since then I have been working at the Post Clearance Audit (PCA) Branch, my favourite place to work in Customs. I suppose that Sri Lanka Customs Administration selected me to the PCA branch because of my professional and academic qualifications as well as my successful achievements at PCA when I was working during the period from 2005 to 2007.

In addition to my GRIPS degree, I obtained a Bachelors Degree in B.Sc. Business Administration (Special) from the University of Sri Jayawardenepura. I also completed the course in Chartered Management Accountancy and now I am a member of the Chartered Institute of Management Accountants-United Kingdom. Because of the membership in this professional body I can use the designations after my name as ACMA-Associated Chartered Management Accountant and CGMA-Chartered Global Management Accountant. Currently I am reading for a Bachelor’s Degree in Laws at the Open University of Sri Lanka, which is a four-year degree program and this year is my final year.

You are currently working as a Superintendent at Sri Lanka Customs. What are your main responsibilities and duties?

As mentioned earlier, currently I am attached to the PCA branch that is responsible for detecting and investigating customs related commercial frauds and errors in collecting revenue. For this purpose PCA is responsible for checking all customs documents after clearance. When we detect any error or fraud we have to deal with them as per the provisions of the Customs Ordinance. These include recovering of additional customs duties, imposing penalties and further forfeitures on unscrupulous importers etc.. For this purpose I have a team of officers with different educational backgrounds such as IT, accountancy and law, in addition to the working experience in various places in Customs.

Within the last 12 months under my guidance and supervision my team was able to recover nearly Sri Lanka rupees 400 million (around 300 million USD) as penalties and further forfeitures, in addition to the recovery of rupees 120 million as additional Customs duties.

In your current capacity, what do you see as the main opportunities and challenges for Sri Lanka over the course of the next five to ten years?

At the WCO/OECD World Conference on Customs Valuation and Transfer Pricing held in Brussels Belgium in 2007

Sri Lanka is now a rapidly developing country. After the war between the Sri Lanka government and the Tamil Tiger terrorists, the vision of the government is to become the “Wonder of Asia”. With the “Good Governance” policies of the new government, the Department of Customs is playing a major role as it is responsible for collecting more than 50% of the total tax revenue to the State. The government has accelerated the infrastructure development such as highways, energy and telecommunication etc.. The aim of the new government is to implement the selected projects based on its urgency, impact and priority.

Sri Lanka’s strategic location in South Asia has given the country many opportunities. The government has already declared opened the newly built Hambanthota Port and the Mattala Mahinda Rajapaksa International Airport as the major projects that were commenced after the war. The Southern and Colombo-Katunayaka highways have already been completed and are now open for public use. The northern and the Colombo-Kandy highways are yet to be commenced. The aim of the government is to promote Sri Lanka as a No. 1 tourist destination.

The government expects from Customs to provide more trade facilitation while collecting the due revenue to the State. Therefore, Customs has to find the right balance between customs controls and trade facilitation. This is essential to achieve the development targets of the country. Being the main revenue collecting body of the government, Sri Lanka Customs Department has the biggest responsibility to collect the due revenue to the State while creating a business-friendly environment and facilitating international trade.

What are some of the biggest challenges you face in your work? And what have been the most interesting or rewarding aspects of your career thus far?

The biggest challenge is to deal with scrupulous importers and exporters who do not pay correct customs duties and do not follow customs and other related laws and regulations. When we work to detect cases we have to act carefully as there have been occasions of our officers receiving life threats. Since Sri Lanka still depends on tax revenue, the tax rates are still higher than in developed countries. There are no proper transaction recording systems maintained by the importers. This has resulted in tax evasions that are difficult to detect at the post clearance stage. This is also a big challenge faced by PCA Section.

Being commended by the Director General of Customs in a few occasions for my outstanding achievements count as one of the most rewarding aspects of my career. In 2009, I was commended for recovering rupees 169 million as penalty from a multinational company for under-invoicing import cargo. In addition, my work at the Policy Planning & Research Directorate was commended by the Director General of Customs in 2003.

Wijeratne with WCO Secretary General, Mr. Kunio Mikuriya, who was a visiting Professor for Customs Law at GRIPS when he was studying at GRIPS.

I have also had the opportunity to participate in many international seminars and conferences. In 2005, I attended a training program on commercial frauds organized by the Malaysian Customs. This was a two-week program with one week for classroom sessions and the other week for field trips. This was a very interesting experience and I was able to meet customs officers from various countries during this period.

In 2007, I represented Sri Lanka Customs at the WCO/OECD World Conference on Customs Valuation and Transfer Pricing held in Brussels, Belgium. During this conference I was fortunate enough to talk with WCO Secretary General, Mr. Kunio Mikuriya, who was a visiting Professor for Customs Law at GRIPS when I was studying in Tokyo.

Last year I attended the Indian Ocean Rim Association (IORA) Customs Trade Facilitation Forum, organized by Australian Customs and Indian Customs held in Bangalore, India.

What led you to GRIPS? What is the most important thing you got out of your studies here, and how has your experience at GRIPS prepared you for future endeavours?

When I was working at the Policy Planning & Research Directorate, I heard that GRIPS had called for applications for the Masters Degree in Public Finance. Out of the number of applicants I was selected by the Customs management as the most suitable candidate from Sri Lanka Customs. This opportunity completely changed my career prospects and after studying at GRIPS I had obtained great confidence to plan and work towards achieving the targets.

What are some of your fondest memories of your time spent at GRIPS? And what do you miss about Japan?

With fellow students during a field trip.

I have very fond memories of visiting the famous Kamakura Buddhist temple along with Mr. Mikuriya, then one of the visiting Professors who taught us Customs Law and currently the General Secretary of the World Customs Organisation. And also I had an opportunity to make friendships with the students of GRIPS from various countries. I especially treasure my friendship with the customs officers I met at GRIPS such as Mojtaba from Iran, Faiz from Pakistan, Vizaad Ali from Maldives and Pyone from Myanmar.

Unfortunately, I could not participate in two trips organized by GRIPS. One was the trip to Okinawa and another one to mount Fuji. However, I am planning to visit Japan again in the near future as a tourist to see the places I missed during my stay in Japan studying at GRIPS.

How do you maintain a balance between your work and the rest of your life? And what is your favourite thing to do when you are not working?

Actually, compared with my colleagues in Customs I feel that I am a hard-working officer. Most of the time I work after normal office hours and I sometimes even work at home to complete work at hand in advance before the deadlines. Therefore, I have only weekends to spend with my wife and our daughter – the only child in my family. They are very understanding and supportive and therefore, I have been able to attain a balance between my busy schedule and family life.

If you could give one piece of advice to anyone considering studying at GRIPS what would it be?

At the graduation day in September 2002

It is great chance to be given an opportunity to study at GRIPS. If you look at the former students of GRIPS many of them are now policy makers in top posts in the government sector. And, as GRIPS has students from over 60 countries you will also have great opportunity to build friendships and networks with government officials around the world.

How would you like to maintain involved with the School? What do you expect from GRIPS as an alumnus?

I know that GRIPS is always keeping track of how their former students are working in their home countries and their achievements by visiting those countries each and every year. They also encourage administrations of government authorities to send students to GRIPS. I am well aware of this because a team from GRIPS visits Sri Lanka almost every year and meets former GRIPS students to see their achievements and also to promote the importance of courses offered by GRIPS to the government authorities.