7. World War I and the 1920s: export-led

boom and bust

(See Handout no.6)

Impact of World War I

When the First World War erupted in July

1914, its consequence on the Japanese economy was at first uncertain. As

the European

major powers began to fight each other, their international trade was suspended, which

meant that Europe could no longer supply textiles, machinery and chemicals to the rest of

the world. It was feared that Japanese investment would be adversely affected.

In reality, Japan did experience severe shortage of high-quality machines and

industrial inputs while their domestic demand surged.

But very soon, it became clear that WW1 would bring a huge bonanza to the

Japanese economy (at least in the short run) because of the sudden increase in global demand for Japanese products. An enormous export-led boom was generated

because (i) global demand shifted from Europe to Japan; and (ii) the US economy was expanding.

Japan's manufactured products were still of inferior quality but could

substitute for European products which were now unavailable.

The macroeconomy, previously suffering from trade deficits and gold reserve

losses, was greatly stimulated by a sharp rise in foreign demand. During WW1,

the domestic price level more than

doubled and real GNP surged (estimated annual growth of close to 10%--see handout

no.4). In

terms of GNP expenditure composition, exports rose, imports were slightly

suppressed, investment was only moderately increased and with a lag (shortage of machinery !), and private consumption fell. What happened was a sharp rise in

output without a corresponding capital stock increase (thus, the operation ratio

and "efficiency" shot up). Domestic consumption was crowded out by foreign demand (forced saving

through inflation). Naturally,

business profits jumped and gold reserves accumulated. This is how

Japan got out of the pre-WW1 balance-of-payments crisis: thanks to a foreign war

and a sharp rise in export demand, not by

macroeconomic austerity. (A similar situation would occur again later, in 1950).

The export-led boom was broad-based. All industries benefited.

Among them,

marine transportation and shipbuilding were extremely profitable and expanded

most strongly. Between

1913 and 1919, total manufacturing output rose 1.65 times while individual

industries enjoyed the following output increases: machinery (3.1 times), steel (1.8

times), chemicals (1.6 times) and textile (1.6 times).

Clearly, this export-led boom was temporary (only as long as WW1 continued,

which meant about 4 years). Japanese manufacturing was still internationally

uncompetitive in cost and quality. Japan was capturing overseas markets under the special condition

of the European war, which artificially boosted both the demand for and the

prices of Japanese exports. Domestically, too, quick import substitution was

possible because European goods did not arrive. In retrospect,

most of the business expansion during WW1 was inefficient, excessive and

unsustainable.

|

|

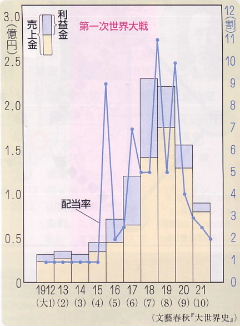

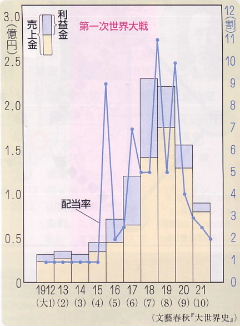

| The sales (the

sum of orange and blue) and

profits (blue) of Nihon Yusen shipping company. The line graph shows the

dividend return on its share (right scale--unit is 10%). |

The narikin in caricature:

he burns a 100 yen note for light so the girl can find his shoes. |

Because of the unprecedented boom, mediocre merchants and producers became suddenly rich

and greatly expanded their enterprises. A class of nouveau riche called narikin

emerged (in Japanese chess, narikin means a pawn becoming a gold

general). They were often without culture or taste and fond of showing off their material

wealth.

WW1 required very little military operation from Japan. Japan did not engage in any serious combat.

But Japan had a military alliance treaty with the UK (1902-1923, with Russia as the potential

enemy), so the

government used this treaty as an excuse for capturing German-occupied territories in Jiaozhou Wan (around Qingdao) in China and islands in the Southern Pacific.

Collapse of the bubble

In 1918 when WW1 ended, a small business setback occurred. But the economy continued

to do well in 1919. Then came the big crash of 1920. This postwar recession

meant that the bubble had finally collapsed. Serious price deflation was

recorded in many key commodities. Within the year of 1920, the price of cotton

yarn fell by 60%, that of silk by 70%, and the stock market index plunged 55%.

There was no downward price rigidity in those days. Macroeconomic adjustment was

effected mostly in prices and less in output.

When the bubble ended, the lack of competitiveness and overcapacity of the Japanese

economy, previously hidden under unsubstantiated exuberance, was now exposed.

Most narikin were bankrupted. Their happy days were short.

After that and throughout the 1920s, Japan went through a series of recession

and a few banking crises (the biggest bank runs occurred in 1927--see lecture

8). The economy slowed down significantly compared with the WW1 period, but no

severe fall in output occurred. Domestic demand was not buoyant but steady.

Recessions were frequent but short-lived. Prices remained flexible. Trade deficits

returned and persisted, financed by the drawing down of the previously accumulated gold

reserves. During the 1920s, the sky above the Japanese

economy was neither sunny nor pouring. It was as if thick clouds gathered and

stayed above the economy, depressing the economic mood of the

country (a bit like now, since the 1990s).

Faced with the onset of a long recessionary period, it is noteworthy how the

Japanese government reacted. It had two policy options: to rescue weakened

industries and banks saddled with bad debt, or to eliminate inefficient units in

order to streamline the economy despite transitional pain. The Japanese

government chose the first option. In particular, the Bank of Japan provided

emergency loans to ailing banks and industries to avoid further bankruptcies and

unemployment. This policy eased the short-term pain but implanted a time bomb in the Japanese economy which exploded several years later.

Development of heavy and chemical industries

But even under the cloudy sky of the 1920s, new manufacturing industries were

growing. Heavy and chemical industries (HCI) were expanding strongly, despite

the relatively weak macroeconomy. HCI growth was broad-based, including steel,

chemicals, electrical and general machinery, artificial silk (rayon), etc. Import

substitution of these industries proceeded rapidly. By the 1930s, Japan could

produce most machines domestically. This was a big change from the Meiji period.

There were several reasons for HCI growth:

(1) Initially, the WW1 boom ignited these industries under the

artificial protection from European products, as explained above.(2) Policy support was available. Fiscal activism (including

military buildup) continued to be pursued by Seiyukai Party (lecture

9) governments, and

tariff protection for emerging HCI was adopted. Government also

promoted the formation of industrial cartels to avoid excess competition and overcapacity.

(3) Electrification proceeded thanks to

the growth of hydraulic power generation. Construction of hydraulic power plants

occupied the largest part of private-sector investment (besides that, private railroad construction was

also buoyant). In Kansai area (Western Japan), a surplus in electricity

emerged so electric

companies adopted discriminatory pricing, charging very low prices to large

corporate customers (marginal cost for producing hydraulic power was virtually zero). This

stimulated the growth of electricity-intensive industries, such as the

production of ammonium

sulfate.

(4) Foreign technology was absorbed through FDI. Japanese companies

(NEC, Shibaura, Mitsubishi Electric, Furukawa, Nissan, and so on) tied up with

American

and European giants (GE, Westinghouse, Siemens, Ford, GM, Dunlop, Goodrich,

and so on) in the fields of electrical machinery, automobile, rubber tire,

and so on.

The business relationship took various forms including Japanese subsidiaries, joint

ventures, equity

participation and technical cooperation.

(5) Industrial linkage was created. For instance, growth of the steel

industry stimulated and supported the steel-using industries like shipbuilding and machinery,

and

vice versa.

As a result of HCI development, a new type of zaibatsu emerged in the

1920s and the 1930s. The largest among them were Nissan, Nicchitsu and Mori.

Compared with the old zaibatsu such as Mitsui and Mitsubishi, new zaibatsu had the

following characteristics: (i) HCI-based (not textile or commerce); (ii) they did not have a

bank as core business; and (iii) heavy dependence on official support and

political connection. They often

invested aggressively in the Japanese colonies such as Korea and Manchuria

(Northeastern China).

Nissan: established in 1928 by Yoshisuke Ayukawa, its full name was

Nihon Sangyo (Japanese Industry). Raising capital from the stock market,

business was diversified into mining, machinery, automobile, chemicals,

fishery, and so forth. Invested heavily in Manchuria. Hitachi and Nissan Motors belonged

to this group.Nicchitsu: established in 1908 by Shitagau Noguchi, its full name

was Nihon Chisso Hiryo (Japan Nitrogen Fertilizer). The main business was

electricity-intensive chemical industries, such as fertilizer, rayon,

medicine, explosives and metal refining. Invested heavily in Korea.

Mori: established during the 1920s by Nobuteru Mori, working

together with Saburosuke Suzuki (founder of Ajinomoto). Its main business

included iodine, fertilizer, aluminum refining, electrical machinery,

explosives, and so on.

Exchange rate volatility

The pre-WW1 world economy enjoyed price stability and free trade under the

international gold standard from the 1880s through 1914. Japan joined the gold

standard and fixed its exchange rate in 1897. Soon, Japanese prices converged

to the world level. But the international gold standard and the fixed exchange

rate system were smashed by WW1, and the Japanese yen started to float in 1917.

After WW1, advanced countries made a number of attempts to restore the prewar

gold standard system without much success. The UK returned to gold in 1925 but

abandoned it again in 1931. The gold standard could not be re-established

because (i) there was less free trade and more protectionism than before (the

global goods market was less integrated); and (ii) governments now cared more

about domestic macroeconomy than external gold convertibility. As a result,

international monetary cooperation was hardly possible.

Japan also tried to return to the gold standard at the prewar

parity ($1 = 2 yen). The government considered

restoring a fixed exchange rate in 1919, 1923 and 1927, but each time failed for various reasons. Throughout this period,

"return to gold" (or "liberalization of gold export") became a national economic goal. Every time the

government announced such a policy intention, expectations drove up the

yen (because the actual yen was more depreciated than the prewar parity) but the yen fell back when

the policy was not realized. The business community blamed domestic banks and

foreign exchange traders (especially those in Shanghai) for speculation. This exchange instability may

have further damaged the Japanese economy faced with slow growth.

Finally, Japan moved back to the gold standard at the

original parity of $1 = 2 yen in January 1930

under Finance Minister Junnosuke Inoue under the Hamaguchi Cabinet (Minsei Party). Before restoring the gold parity, Inoue implemented

a macroeconomic austerity program and deflated the economy in order to return to the now-overvalued exchange

rate. In his speech, Inoue said:

"Our economy remains very unstable because of the export ban on gold

[non-convertibility

to gold and the floating yen]. We must liberalize gold export [restore the fixed

exchange rate] as soon as possible. But we cannot liberalize gold export

without preparation. What is required for preparation? The government must

tighten the budget. The people must accept this fiscal austerity and they

themselves must reduce consumption. If that happens, prices will start fall

and imports will begin to contract. That will create an upward pressure on the

yen in the foreign exchange. ... We face a recession without an end in sight.

If nothing is done, we will sink deeper into the recession. In the past,

Japan often overcame recessions thanks to external stimuli. But the current

situation does not permit such a hope because the European economies are

severely weakened by the last war [WW1]. Under such circumstances, we should not hope for

foreign demand to bail us out. Recovery must be generated by our hands. There

is no way out except through our own austerity."

|

|

| Junnosuke Inoue

(1869-1932): the banker, Bank of Japan governor and finance minister. |

Inoue writes

"Liberalization of Gold Export"in his calligraphy in

January 1930 as Japan returned to the gold standard. |

But unluckily, Inoue's deflation policy coincided with the beginning of the Great Depression in the world

economy.

Japan was thrown into a very serious deflation spiral, unemployment surged, and

popular discontent against Inoue's policy mounted. The

gold standard was abandoned two years later by the succeeding Seiyukai

government, in December 1931.

Incidentally, in England, John Maynard Keynes warned in 1925 that the UK should not return

to gold at the prewar exchange rate, because the equilibrium exchange rate had shifted

due to international price divergence. If an overvalued exchange rate was

chosen, he predicted that a recession would ensue. Keynes calculated that the

sterling pound would be 10% overvalued at the prewar parity. In Japan, too, Tanzan

Ishibashi (economic journalist at Toyo Keizai Shimposha) argued for a return to the gold standard at a

new, more depreciated parity. But Ishibashi was in the minority.

However, Inoue's idea was that Japan actually needed deflation. He argued that

unprofitable firms and banks survived through the 1920s without merger,

consolidation or closure, because the government and the Bank of Japan generously helped them.

He thought deflation was painful but necessary to remove those inefficient

industries. But many people blamed--and still blame--him for pursuing the

deflationary policy too aggressively when the world was in the Great Depression.

But Inoue never relented until he was finally assassinated. Maybe his idea was

sound in principle but the timing and degree were unfortunate.

Shidehara Diplomacy in the 1920s

As noted at the end of lecture 6, Japan began to emerge as a serious threat to both the

West and East Asia by the end of the Meiji period. After WW1, Japan tried to allay these fears

and rebuild good relationship with the West (especially the US) and East Asia. Kijuro

Shidehara served as a foreign minister a few times (1924-1927 and 1929-1931,

Minsei Party governments) during this period. He vigorously promoted this reconciliation policy

(called Shidehara Diplomacy). As a result, Japan's external policy in the

1920s was less belligerent compared with before or after.

In 1921, the Washington Conference for Naval Disarmament was convened by the

US, and Japan was invited to attend. This conference put upper limits on

principal battleships of the major countries. In terms of tonnage ratios, the

possession of principal battleships was restricted as follows: US:5, UK:5,

Japan:3, France:1.67, Italy:1.67. The Japanese delegation willingly signed this

agreement because of fiscal pressure (the navy wanted more ships but the

national budget

was out of balance), in addition to the wish to show good faith to the Western

powers.

|

|

| Japan attended the

Washington Conference (1921-22) with both hope and concern. Global

reduction of naval capacity was welcome for Japan which was facing a

fiscal crisis. But Japan also feared that the other big powers might

harm Japan's interests. |

Kijuro Shidehara (1872-1951) was

foreign minister in much of 1924-31; and prime minister in 1945-46. |

Shidehara believed that good relationship with the US was critical to Japan.

Moreover, he felt that Japan, as a first-class country and a member of the Big

Five, had the responsibility to strive for global peace and prosperity. As to

China, he wanted to protect Japanese interests in China by non-military means

(i.e. through diplomacy). Shidehara's idealism is evident in his parliamentary speech (January 1925).

"At present, there is clearly a global movement toward solving

all international issues through understanding and cooperation among concerned

powers, and not by narrowly self-serving policies, excessive use of militarism

or interventionism. ... Japan is no longer permitted an isolated and independent

existence in the Far East, interested only in its own affairs. As a major member

of the League of Nations, Japan now bears a heavy responsibility for promoting

world peace and happiness of the human race. Japan must participate in the

discussion of all these important issues, even if they have only indirect

influence on Japan's own interest. The fact that Japan must bear such

responsibilities is beyond the question; it is necessitated by the force of

history. The great progress of history is making us to take up these

responsibilities."

But the Japan-US relationship gradually deteriorated due to the problem of

Japanese immigrants on the US Pacific coast (California, Oregon and Washington).

Because Japanese (and to some extent Chinese) immigrants worked too hard and had

different cultures, they were discriminated against by Americans. Their schools were

segregated, their freedom was restricted, and finally their property was

confiscated. The Japanese government agreed to stop sending new immigrants to the US

but demanded fair treatment of the Japanese already there. This issue soured the

bilateral relationship.

As to China, Shidehara's policy of no

military intervention was severely criticized by the

military and the hardliners as "coward diplomacy." It should be noted

that even mass media echoed and blamed Shidehara for being too soft on China.

During 1927-1929 when the Tanaka Cabinet was in place and Shidehara was out,

Japan sent troops to China. Tanaka belonged to Seiyukai Party and Shidehara

belonged to Minsei Party.

Finally in 1931, the Manchurian Incident broke out. The Japanese army

stationed in China (Kantogun) began to invade Northeastern China. This

action was made independently from Tokyo, and the Japanese government could not stop

its

army. Shidehara's call for immediate peace was ignored. Shidehara Diplomacy

ended this way.

Taisho Democracy

Roughly coinciding with the Taisho period (1912-1926), various

social movements asking for more democracy and human rights became active. This included

protestation against non-elected governments, women's liberation, equal

rights for the discriminated class (from the Edo period), universal suffrage, cultural

freedom, and so on. These movements were collectively called Taisho

Democracy.

One of the most eminent intellectual leaders of Taisho Democracy was Sakuzo

Yoshino (1878-1933), professor of political science at Tokyo University (photo). He published many

articles in popular journals. His democracy theory (minpon shugi)

emphasized the need to improve the actual implementation of the system

of constitutional government (that is to say, establishing democratic institutions is not enough). He also stressed the role

of the elite class for guiding people and the desirability of universal

suffrage. By expanding the voter base from a few rich to the general public, he

argued that corruption and money politics would cease and politics based on a

broader national vision would begin (I must say that Prof. Yoshino was a bit too

optimistic there). One of the most eminent intellectual leaders of Taisho Democracy was Sakuzo

Yoshino (1878-1933), professor of political science at Tokyo University (photo). He published many

articles in popular journals. His democracy theory (minpon shugi)

emphasized the need to improve the actual implementation of the system

of constitutional government (that is to say, establishing democratic institutions is not enough). He also stressed the role

of the elite class for guiding people and the desirability of universal

suffrage. By expanding the voter base from a few rich to the general public, he

argued that corruption and money politics would cease and politics based on a

broader national vision would begin (I must say that Prof. Yoshino was a bit too

optimistic there).

On the role of the elite, Professor Yoshino wrote:

"Some may argue wrongly that the elite class has no place in

democracy. But this is not so. Of course, if a small number of

people form an exclusive class and monopolize politics independently

from the people, it will produce many bad results. But if the elite

humbly mingle with the general public, nominally serving and following

them but in substance guide them spiritually and for the public good,

they will play the role of the truly wise. ... Democracy will not

develop in a sound way if the uninformed people literally rule.

Formally speaking, the majority must always be the basis of political

activities. But they need intellectual leaders in their minds. They must

rely on a small number of wise and capable people. A great nation will

emerge when the majority is guided intellectually by the few who are

wise. The elite has this responsibility in a modern state."

("Discourse on the Principle of Constitutional Government and the

Way to Fully Develop its Potentiality," 1916)

In 1925, the Universal Suffrage Law was enacted, extending the voting right to

all males at 25 years of age and above, without income restriction. But in the

same year, the Peace Preservation Law was also passed in order to crack down on

communists and anarchists (it should be noted that other countries had similar laws

around this time, too). The extension of suffrage to women must wait until 1945.

In the actual political process, the great achievement of Taisho Democracy

was the succession of party cabinets from 1924 to 1932. The leader of the

political party having the largest number of parliamentary seats formed the

government (instead of appointed old politicians or military generals). When his

policies failed, the leader of another party replaced him. This system was not

formally institutionalized but actually practiced (called kensei no jodo,

or the normal way of constitutional government). But this practice was later

terminated by the pressure from the military and a series of political assassinations.

|

<References>

Arisawa, Hiromi, ed., Nihon Keizaishi 1 (History of Japanese

Industries vol.1), Nihon Keizai Shinbunsha, 1994.

Iwanami Shoten, Nijukozo, Nihon Keizaishi 6 (The Dual Structure, Japanese Economic History vol.

6), T. Nakamura and K. Odaka, eds, 1989.

Toriumi, Yasushi,

Nihon no Kindai: Kokumin Kokka no Keisei Hatten to Zasetsu (Modern Japan:

The Formation, Development and Collapse of the Nation State), University of the

Air Press, 1996.

Yoshino, Sakuzo, "Keisei no Hongi o Toite sono Yushu no Bi o Nasu no

To o Ronzu" (Discourse on the Principle of Constitutional Government

and the Way to Fully Develop its Potentiality), Chuo Koron, January 1916.

One of the most eminent intellectual leaders of Taisho Democracy was Sakuzo

Yoshino (1878-1933), professor of political science at Tokyo University (photo). He published many

articles in popular journals. His democracy theory (minpon shugi)

emphasized the need to improve the actual implementation of the system

of constitutional government (that is to say, establishing democratic institutions is not enough). He also stressed the role

of the elite class for guiding people and the desirability of universal

suffrage. By expanding the voter base from a few rich to the general public, he

argued that corruption and money politics would cease and politics based on a

broader national vision would begin (I must say that Prof. Yoshino was a bit too

optimistic there).

One of the most eminent intellectual leaders of Taisho Democracy was Sakuzo

Yoshino (1878-1933), professor of political science at Tokyo University (photo). He published many

articles in popular journals. His democracy theory (minpon shugi)

emphasized the need to improve the actual implementation of the system

of constitutional government (that is to say, establishing democratic institutions is not enough). He also stressed the role

of the elite class for guiding people and the desirability of universal

suffrage. By expanding the voter base from a few rich to the general public, he

argued that corruption and money politics would cease and politics based on a

broader national vision would begin (I must say that Prof. Yoshino was a bit too

optimistic there).