INTERNATIONAL

ECONOMICS—FINAL EXAM

(3-4

pm, July 18, 2003)

Instructor:

Professor Kenichi Ohno

|

This is a closed book exam. Use your pen and brain

only.

PLEASE

WRITE CLEARLY. Poor handwriting will be

ignored, resulting in lost points.

ANSWER

ALL QUESTIONS. Use only TWO

official answer sheets. Use only FRONT side of each answer

sheet. Allocate space carefully.

Clear

and concise answers are preferred. Long answers do not guarantee high

points.

After

the exam, model answers will be distributed. Graded answer sheets will be

returned to the students a few days later and overall results will be

posted in the web. |

Answer

in any order; each question carries 20 points

Q1.

Assuming perfect capital mobility and a floating exchange rate, what does the

Mundell-Fleming model predict about the effectiveness of monetary policy?

Q2. Why did the Bretton

Woods exchange rate system collapse? Also discuss Triffin’s dilemma.

Q3.

What is a currency board ? What are its merits and demerits?

Q4.

Describe the empirical methodology used by G. Kaminsky, S. Lizondo and C.M.

Reinhart, “Leading Indicators of Currency Crises” (IMF Staff Papers,

March 1998—reading assignment (B)). In your opinion, can future currency

crises be predicted?

Q5.

Describe Kazakhstan’s response to the Russian crisis during 1998-99. How did

it differ from the crisis response of the East Asian economies during 1997-98?

Model

answers

(Other answers are often possible)

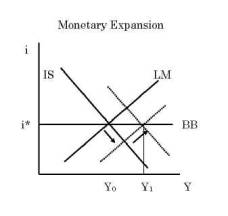

Q1. Under the described situation, monetary policy is

very effective; it can raise income to a greater extent than under a

closed economy. A rightward shift of the LM curve lowers the domestic interest

rate, prompting a massive capital outflow and exchange rate depreciation.

Depreciation in turn stimulates net exports, shifting the IS curve to the right.

Since LM and IS both move to the right, income is doubly increased. [Optionally,

you can use a diagram to explain.]

Q1. Under the described situation, monetary policy is

very effective; it can raise income to a greater extent than under a

closed economy. A rightward shift of the LM curve lowers the domestic interest

rate, prompting a massive capital outflow and exchange rate depreciation.

Depreciation in turn stimulates net exports, shifting the IS curve to the right.

Since LM and IS both move to the right, income is doubly increased. [Optionally,

you can use a diagram to explain.]

Q2. The BW system came

to an end because the global nominal anchor (monetary discipline of the center

country) eroded. In the late 1960s, American monetary policy became expansionary

due to welfare cost, the war in Vietnam, space race with the USSR, etc. This

created domestic inflation and downward pressure on the dollar against gold as

well as other currencies. The gold-dollar link effectively ended in 1968 and

exchange parities collapsed in 1971-73. However, Triffin’s dilemma asserts

that the US cannot be blamed because it faced an impossible choice. To supply

global liquidity, it had to run a trade deficit. But to maintain confidence, it

must not run a trade deficit.

Q3.

A currency board is an arrangement where base money is issued only against the

equal holding of international reserves. In other words, the monetary authority

does not provide credit to the government or commercial banks. This removes its

discretionary power. The merits of the currency board include greater

credibility for convertibility and price stability. Its demerits are the loss of

monetary autonomy and the lack of “lender of last resort” function in the

event of a financial crisis.

Q4. A currency

crisis is defined as a combined depreciation and international reserve loss

beyond a certain threshold. The authors adopt the signals approach where

monthly indicators with high predictive power are selected and ranked.

Overvaluation, banking crises, exports, etc. are found to be such signals.

However, if currency attacks occur as a result of unstable market psychology

rather than poor fundamentals, economic variables may not be good predictors of

future crises. Furthermore, if many types of crisis exist, or if causes shift

over time, models based on past average may not work.

Q5.

Kazakhstan was severely hit by the Russian crisis through export price decline,

export market loss and surging imports. At first, the government adopted a

faster currency crawl, a bit tighter macro stance, and temporary trade and

capital controls. After several months, it finally gave up and floated the

tenge. As the floating began, various measures to soften the blow to the

consumers, banks and enterprises were taken (50% forex sale requirement,

incentive for not withdrawing tenge deposits, etc). Compared with East Asia’s

crisis, Kazakhstan’s response was remarkable in that (i) sharp macroeconomic

tightening was avoided; (ii) non-market defensive measures were taken; and (iii)

structural reform was not accelerated during the crisis.

Q1. Under the described situation, monetary policy is

very effective; it can raise income to a greater extent than under a

closed economy. A rightward shift of the LM curve lowers the domestic interest

rate, prompting a massive capital outflow and exchange rate depreciation.

Depreciation in turn stimulates net exports, shifting the IS curve to the right.

Since LM and IS both move to the right, income is doubly increased. [Optionally,

you can use a diagram to explain.]

Q1. Under the described situation, monetary policy is

very effective; it can raise income to a greater extent than under a

closed economy. A rightward shift of the LM curve lowers the domestic interest

rate, prompting a massive capital outflow and exchange rate depreciation.

Depreciation in turn stimulates net exports, shifting the IS curve to the right.

Since LM and IS both move to the right, income is doubly increased. [Optionally,

you can use a diagram to explain.]