|

|

|

|

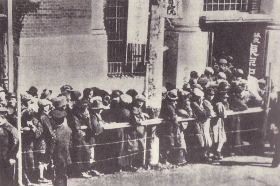

Scenes from Tokyo immediately after the Great Kanto Earthquake. |

||

(See Handout no.6)

Kikan ginko (literally, institution bank) is a term describing a bank set up to serve only one or a few firms. It is captured and subordinated by the parent firm and has no management independence. Naturally, it has many weaknesses:

--Non-separation of ownership and management (the same boss often owned and managed the firm and the bank)

--No information disclosure

--No portfolio diversification

--No capability of risk assessment or project evaluation

What typically happened was something like this. A famous family in a certain local district wants to start a business. The family establishes a company but wants to keep it under its full control, without going public or borrowing from someone else. To finance its activities, a bank is set up by the same family. Since the family has a good name locally, many people deposit their savings with this bank, believing it is safe and without knowing its financial situation. Thus, many kikan ginko were established throughout the country. There were over 2,000 banks in Japan then--that was a bit too many.

When the economy boomed, even dubious banks enjoyed prosperity. But when it slowed down after WW1, kikan ginko started to have a mounting bad debt problem. But since its balance sheets were not open, outsiders could not judge the size of the problem. As noted earlier, during the 1920s the government and the Bank of Japan (BOJ) supported weak banks and firms with emergency loans, rather than closing them immediately. Overcapacity and bad debt continued.

On September 1, 1923, Kanto Region was shaken by a huge earthquake (7.9 on Richter scale). Tokyo and Yokohama were badly destroyed. The largest part of destruction was by fire. Japanese houses were mostly wooden and the quake hit slightly before noon, when most families were cooking lunch. 100,000 people were killed while another 43,000 were missing. Housing damage totaled 700,000 units. Foreign observers praised Japan for remaining calm and orderly in this calamity, but actually many Korean residents were murdered based on false rumors.

|

|

|

|

Scenes from Tokyo immediately after the Great Kanto Earthquake. |

||

Japan is an earthquake country. It is impossible to avoid earthquakes anywhere in Japan. Earthquakes are also related to volcanoes and hot springs. The main reason for all this is because the Japanese Archipelago is situated where four moving plates meet on the earth's crust. There are basically two types of earthquakes. First, when these plates run into each other and one of them sinks slowly toward the inside of the earth, enormous strain is accumulated and when it is released, a big earthquake occurs. These inter-plate earthquakes occur deep down and affect a large area. Second, there are many active faults near the surface and when they move, an earthquake occurs. They are smaller in magnitude and impacts a smaller area, but since it is shallow, local damage could be immense.

The Great Kanto Earthquake was of the first type. Recent quakes in Kobe and Taiwan were of the second type.

The first type occurs more or less regularly, since the speed of plate movement is given. Historically, big earthquakes hit Tokyo every several decades (some more severely than others). The last one was in 1923 so it is about time another one hits. But seismologists have not detected any sign of that yet. They are more worried about Shizuoka area especially in the next few years (they have already named it Tokai Earthquake even before it occurs!). Another potential area is off Shikoku and Kii Peninsula, among others. If the seismic center is off the coast, tsunami (tidal waves) may be generated.

The second type is more difficult to predict and could happen anywhere.

Back to 1923. Immediately after the Great Kanto Earthquake, BOJ extended special emergency loans to banks in the affected Kanto Region. This was done in the form of rediscounting earthquake bills.

Earthquake bills (commercial bills originating in the designated area affected by the quake) were first taken to banks for "discounting" (banks buy the bills from firms and pay cash after subtracting interest between now and the maturity date). In this way companies could receive immediate liquidity. The banks in turn took these bills to BOJ for "rediscounting" (BOJ buys them for cash), so banks too could get liquidity. In this way, BOJ tried to inject liquidity and sustain economic activity after the earthquake. With this rediscounting facility, even if many firms failed to settle commercial debt because of earthquake damage, the financial system would not seize up.

While this temporary rescue protected the Japanese financial market, it also created a new problem. Since BOJ rediscounted commercial bills originating in Kanto Region without discrimination, firms and banks previously saddled with bad debt (unrelated to the earthquake) happily brought their non-performing bills to BOJ. They took advantage of this policy to exchange bad debt for good cash.

If the companies' problems were truly caused by the earthquake, some of them may close business but most of them should resume operation after a while, and BOJ should be able to redeem most of the earthquake bills. But in reality, after two years, only about half the amount was settled by the issuing companies. The rest was a stock of non-performing debt largely unrelated to the Great Kanto Earthquake. This was the so-called "earthquake bill problem."

In order to "normalize" earthquake bills, the government prepared two draft laws. These laws intended to do the following:

--Bad bills held by commercial banks will be rescheduled for 10 years with government bonds as collateral (i.e., conversion of short-term debt to long-term debt).--Government will provide BOJ with the maximum of 100 million yen to write off BOJ's losses related to the earthquake bills (i.e., debt forgiveness using public money).

These bills were debated in the parliament in the spring of 1927.

|

| Finance Minister Naoharu Kataoka |

Finance Minister Naoharu Kataoka was very eager to pass these earthquake bill laws, but the oppositions criticized the government for bailing out big banks and businesses with taxpayers' money. They demanded that the government disclose the amounts of bad bills and the names of banks which held them (very little was disclosed at that time; there were only rumors). They even argued that government's true intention might be to help political friends.

In the debating process, the size of bad debt was gradually known. People were shocked at the enormous size of non-performing loans.

On March 14, 1927, Minister Kataoka was answering pestering questions in the Budget Committee of the House of Representatives. He was frustrated that the opposition did not understand the seriousness of the problem and wanted to debate endlessly. To make the point that the situation was critical, he announced the latest news that crossed his desk: "Tokyo Watanabe Bank just went bankrupt this morning." This news was an unexpected bomb to the financial market as well as people at large. Immediately, depositors queued up in front of banks to withdraw their money. Many banks in the Tokyo area closed.

This was the first shock wave of bank runs. In fact, this was a relatively small financial crisis in the Tokyo area only. The worst was yet to come.

In reality, Tokyo Watanabe Bank was not bankrupt, technically speaking. It was having trouble getting liquidity but the problem was solved shortly. But the bureaucrat carrying news to the finance minister forgot to cancel the first report. Some say Tokyo Watanabe Bank was happy with the finance minister's statement. The bank actually wanted to close but needed a good excuse. Now the bank management could blame Mr. Kataoka instead of themselves.

Many people criticized--and still criticize--Minister Kataoka for the slip of tongue which ignited the 1927 financial crisis. But it is very clear that, with or without his improper statement, the Japanese financial system was facing a huge bad debt problem. The true cause of these bank runs was structural, and we cannot blame just one individual for everything.

Suzuki Shoten was a new trading company of narikin type, growing rapidly during WW1 through speculative businesses. Its main office was in Kobe and its general manager was Naokichi Kaneko. At one time, its sales turnover even surpassed those of big zaibatsu trading companies like Mitsui and Mitsubishi. It had strong connections with Taiwan (Taiwan Colonial Administration, Bank of Taiwan, and Taiwan sugar business) and was given a monopoly right to market Taiwan-made camphor. (Suzuki is the name of the founder and "shoten" means shop or store.

But after WW1 and the bubble burst, Suzuki Shoten faced a bad debt problem like other narikin businesses. It asked the Bank of Taiwan (BOT), its main bank, to extend rescue loans. The Bank of Taiwan was a special bank playing the double role of Taiwan's central bank as well as a commercial bank. Despite its semi-official status, it actively extended loans to mainland Japan, including Suzuki Shoten. As its loans to Suzuki became overdue, it could not terminate its relation with Suzuki because it occupied too large a part of its loan portfolio. So it decided to continue to lend (rolling over existing debt, plus new lending), delaying the final solution and accelerating the debt snowball. This was the kikan ginko problem writ large.

|

|

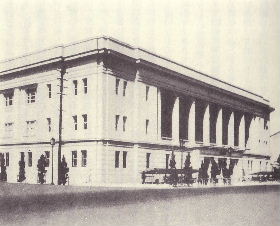

| Depositors queued up in front of a bank after Mr. Kataoka's statement. | The headquarters of the Bank of Taiwan. |

If you have a small debt to your bank and your business fails, you are in trouble. If you have a huge debt that goes bad, the bank is in trouble.

By the end of 1926, the largest part of the unsettled earthquake bills was attributable to the Bank of Taiwan and Suzuki Shoten (48.4%). So normalizing the earthquake bills meant solving the BOT-Suzuki problem.

On March 26, 1927, the Bank of Taiwan finally refused any more lending to Suzuki Shoten. This news was a big shock because it revealed the desperateness of the situation beyond anyone's imagination. Previously, people had expected that the government would somehow manage this problem since BOT was a special bank and Suzuki was too big to fail (moral hazard problem!). Naokichi Kaneko, the Suzuki's general manager, even said, "Don't worry, the government will never fail us." No one thought the government would abandon them and let BOT give up on Suzuki. When that became reality, the second chain of bank runs started, this time in Kansai area because Suzuki's main activity was in Kansai (Osaka, Kobe and Kyoto).

|

|

The Bank of Japan today. The old building (front) is unchanged from the time of the Showa financial crisis. The new building (back) was added later. |

The Bank of Taiwan's balance sheet was irregular. On the asset side, bad loans to Suzuki loomed large. On the liabilities side, instead of normal deposits, the bank relied very heavily on short-term interbank "call" loans as well as borrowing from the Bank of Japan. As soon as the breakup between BOT and Suzuki was announced, other commercial banks naturally pulled their call loans out of BOT. The only way for BOT to survive now was to ask for more BOJ loans.

At this time, even BOJ refused to extend additional loans unless a new law was enacted to cover BOJ's future losses. For a long time, under political pressure BOJ was generously helping troubled banks. But this undermined BOJ's own financial soundness. Now at this critical moment, for the first time BOJ as a central bank became more independent from the government and refused to play the role of the "lender of last resort." The government was forced to quickly issue a special law (an emergency imperial edict) to satisfy BOJ's demand. The content of the proposed edict was as follows.

--BOJ can extend special loans to BOT without collateral until end May 1928.

--The government will compensate BOJ for losses related to these loans up to 200 million yen.

An imperial edict must be approved by the Privy Council and signed by Emperor. The government expected it to pass easily. But the Privy Council, under strong influence of conservative politicians, unexpectedly rejected the proposed edict. They did so because the members did not like the government's conciliatory diplomacy toward China ("Shidehara Diplomacy"--see lecture 7). When the edict was rejected, BOJ refused to lend to BOT. This forced BOT to close on April 18, 1927 (on the same day, another bank--Omi Bank specializing in cotton business--also closed).

The closure of the Bank of Taiwan and Omi Bank started a chain reaction of bank runs all over Japan. This was the third and most severe financial panic of this year (1927).

On April 22, the government ordered all banks to "voluntarily" close for two days, and simultaneously issued a three-week "moratorium" on virtually all financial obligations. These measures were intended to protect banks against deposit withdrawals (except for small amounts to cover people's living expenses). Meanwhile, banks showed off tall stacks of currency notes to depositors. Calm was restored and things went back to normal when the moratorium expired--except, of course, the banks that disappeared and the depositors who lost their savings.

The Financial Crisis of 1927 was basically a banking crisis. Its macroeconomic impact was negative but not catastrophic. The worst macroeconomic downturn would arrive a few years later, for other reasons (lecture 9).

The most significant consequence of the 1927 banking crisis was financial concentration.

After the crisis, the government liquidated or merged unsound banks into about two dozen new banks within a year or so. In the process, typical depositors at a bankrupted bank lost 35-50% of their savings. The government further encouraged merger of remaining small banks by imposing minimum capital size and other requirements. Naturally, people also shifted their deposits from small local banks to large banks with big names. The number of commercial banks fell from more than two thousand in 1919 to 625 in 1932. Deposits were increasingly concentrated in "Big Five" banks: Mitsui, Mitsubishi, Sumitomo, Yasuda and Daiichi. This reduced the supply of bank credit to small and medium enterprises. But we may also say that the elimination of small kikan ginko was good, contributing to the modernization of the Japanese banking sector.

Clearly, the financial framework of the 1920s was inadequate compared with today. Deposit insurance did not exist, proper bank supervision and regulatory measures (such as the BIS capital adequacy rule) were not in place, and BOJ did not fulfill its role as the lender of last resort.

But on this last point, we can still debate. Should BOJ be blamed because it did not provide liquidity to BOT at the critical moment? We need to consider the following aspects, and final judgment is up to everyone.

--BOJ had been forced to rescue too many banks against its will and against its financial soundness. At some point, it had to reassert its political independence. While immediate consequence of letting BOT fall was severe, endless provision of emergency loans might not be the right answer.--BOJ knew that immediate provision of unlimited liquidity was required to avoid a financial crunch. But among the general public and in the parliament, political resistance to injecting public money into a few big banks was so strong. For this reason, BOJ had to take a tough stance toward BOT.

--Bank closures are painful in the short run but, if properly done, they will ensure the soundness of remaining banks in the long run.

|

Additional Questions & Answers

<References>

Banno, Junji, "Hamaguchi Osachi to Koizumi Junichiro" (Osachi Hamaguchi and Junichiro Koizumi), Ronza, October 2001. (see above)

Kamekichi Takahashi and Sunao Moriguchi, Showa Kinyu Kyoko Shi (History of Showa Financial Crisis), Seimeikai Shinsho 1968, revised and reprinted in Kodansha Gakujutsu Bunko 1993.

Takafusa Nakamura, Showa Kyoko to Keizai Seisaku (Showa Depression and Economic Policy), Kodansha Gakujutsu Bunko, 1994.